Charitable remainder trust calculator

Calculation of Tax Deduction for Charitable Remainder Annuity Trusts. Download a PDF of this article.

Charitable Remainder Trust Calculator

Charitable remainder trust calculator.

. Gifts Everyone Can Afford. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The Toolkit Calculator is designed to help professionals determine the tax impacts of making various charitable gifts.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Find Fresh Content Updated Daily For Charitable remainder trust calculator. A charitable remainder trust CRT is an irrevocable trust meaning it cannot be modified or terminated without the beneficiarys.

The gift planning information presented on this. Gifts That Protect Your Assets. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

During its term the trust pays a. The calculator below determines the charitable deduction for any of the following gift types. Home Ways to Give Plan Your Legacy Giving That Provides Income Charitable Remainder Trust Charitable Remainder Trust Gift Calculator.

This calculator indicates the charitable income tax deduction available to Donors making a current contribution to a currently offered US. Charitable Remainder Annuity Trust. Ad Pursue Your Philanthropic Vision With Bank of America Private Bank.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Wills Trusts and Annuities. Your calculator results have expired.

Why Leave a Gift. Charitable Remainder Trust Gift. Charitable Remainder Annuity Trust link opens in new window - A great way to provide yourself or your beneficiaries with a steady fixed amount of income each year.

California Charitable Remainder Trust Calculator. You irrevocably transfer cash securities or other property to a trust. Charitable Lead Annuity Trust Calculator.

Charitable Remainder Unitrust Calculator. Charitable Remainder Annuity Trust Calculator Results. Contribute cash securities or appreciated non-cash assets.

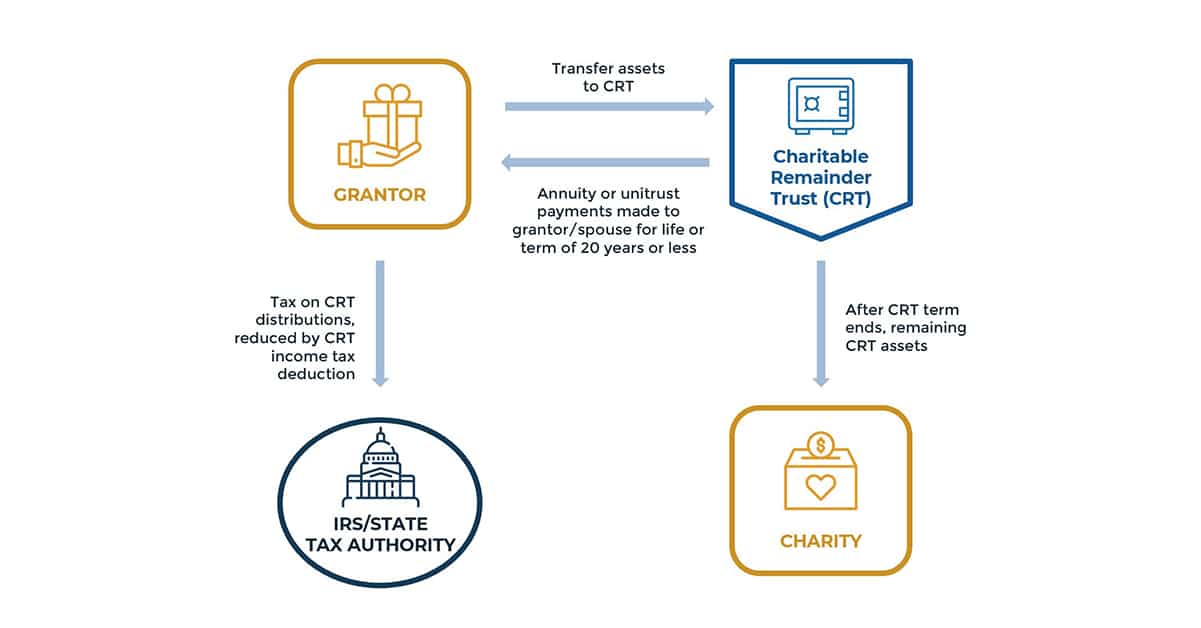

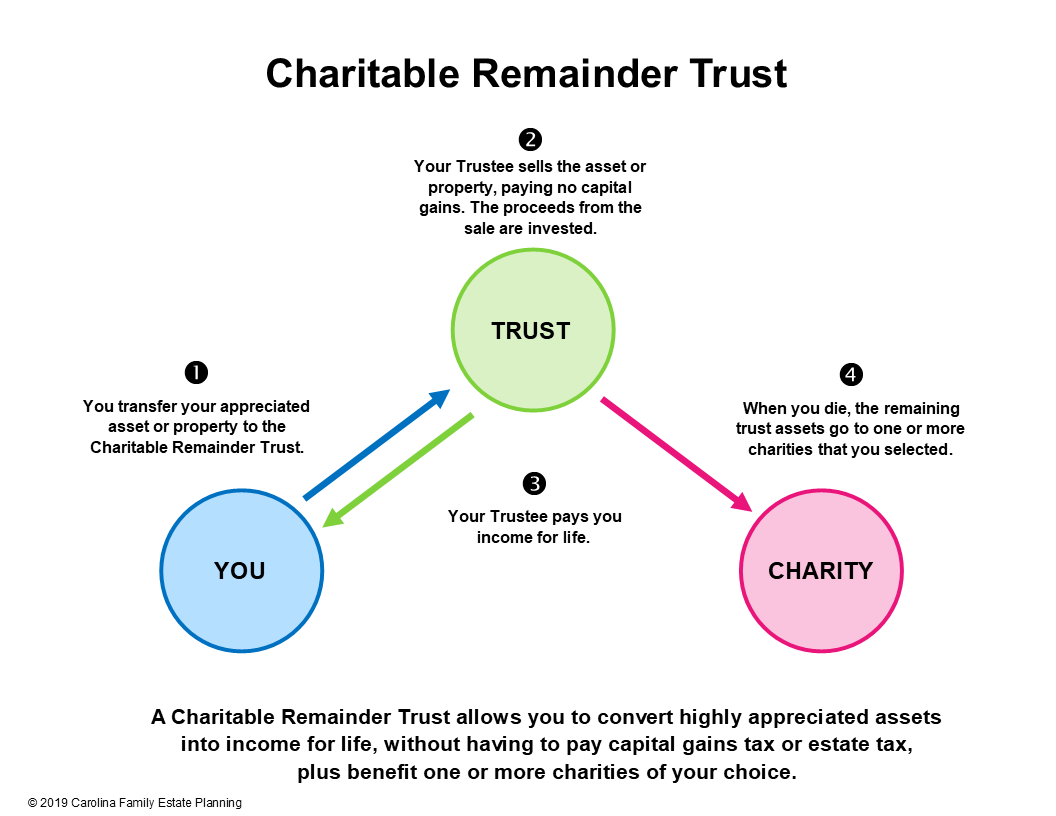

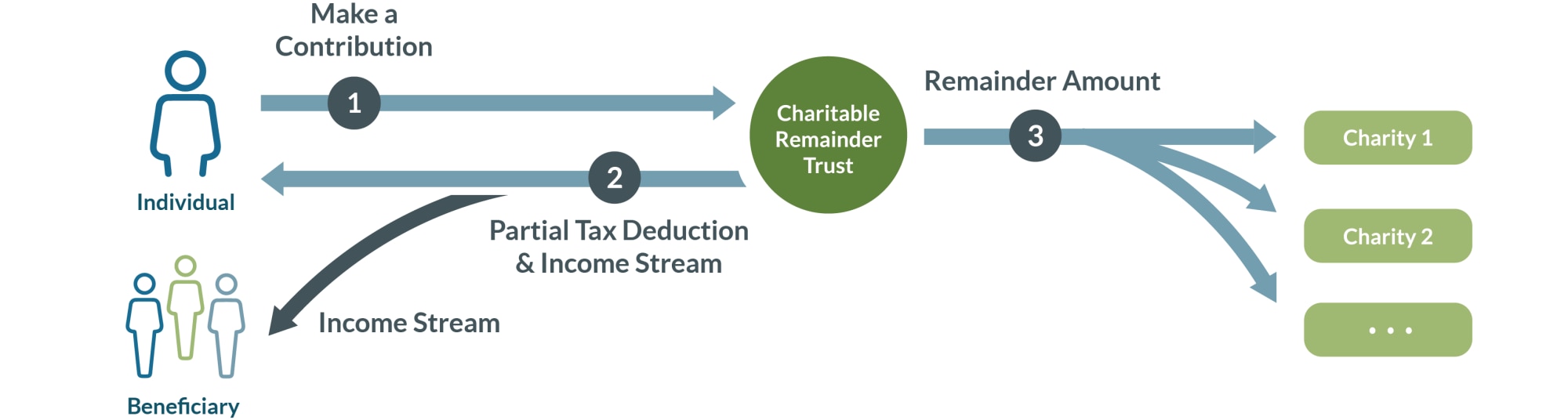

A Charitable Remainder Trust CRT is a gift of cash or other property to an irrevocable trust. A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or eliminate capital gains. A charitable remainder trust calculator that allows charitable and philanthropic individuals as well as non profit organizations to measure potential tax benefits and growth projections of a.

The donor receives an income stream from the. Enter the amount of the. You receive an income tax deduction and pay no capital gains tax.

Ad Supporting charitable giving since 1999. Please click here to start another calculation. Paul Dudley White Legacy Society.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. In a charitable remainder trust. Wills Trusts and Annuities Home Why Leave a Gift.

Fair market value of property transferred. Charitable Remainder Annuity Trust CRAT This An Annuity Trust also called a Charitable Remainder Annuity Trust or CRAT pays a fixed percentage of the initial value of trust assets. Ad Search For Answers From Across The Web With Topsearchco.

You can greatly reduce or even eliminate gift and estate tax on trust assets passing to familyif some trust income goes to MPI for a few years. A donor transfers property cash or other assets into an irrevocable trust. Ad Understand the different types of trusts and what that means for your investments.

Charitable Remainder Unitrust Calculator. Gifts That Pay You Income. Gifts That Protect Your.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Charitable Remainder Unitrust Calculator A great way to make a gift to American Heart Association receive payments that may increase over time and defer or eliminate capital gains. Learn how to maximize your impact.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Wills Trusts and Annuities. Present value of remainder interest in annuity trust factor as a percent.

The trusts basis in the transferred assets is carryover basis which is. Please click the button below to open the calculator.

Charitable Remainder Trust Calculator Crt Calculator

Charitable Remainder Trusts University Of Montana Foundation University Of Montana

Charitable Remainder Unitrusts Giving To Stanford

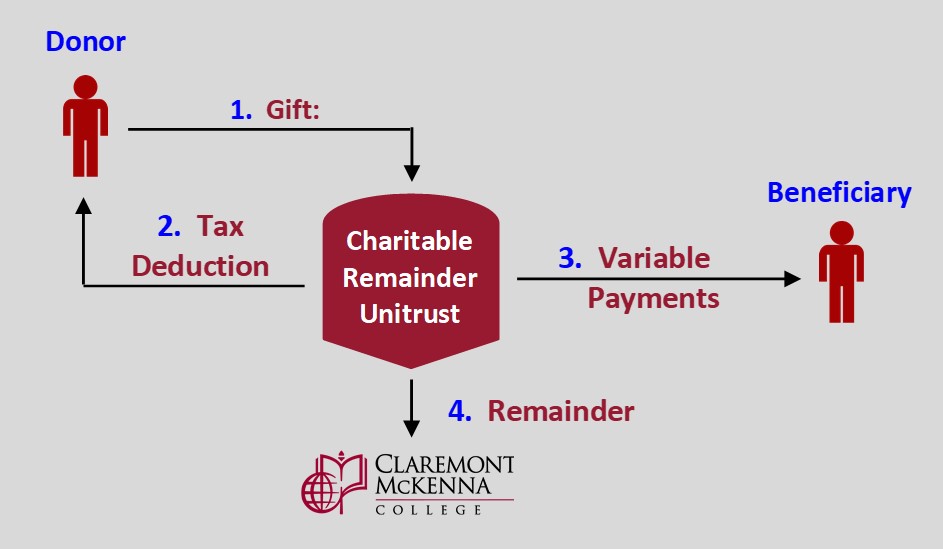

Charitable Remainder Unitrust Claremont Mckenna College

Charitable Remainder Trusts 3 Calculating Deductions Youtube

Charitable Remainder Unitrust University Of Virginia School Of Law

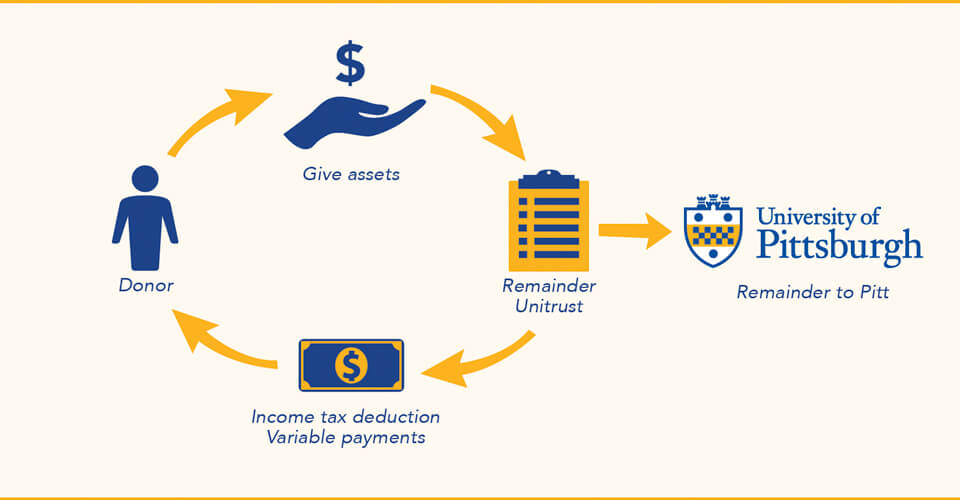

Charitable Remainder Trusts The University Of Pittsburgh

Charitable Remainder Trust Gift Calculator American Association For Cancer Research Aacr

Charitable Remainder Trust Guide Learn With Valur

Charitable Remainder Trust Calculator

Charitable Remainder Trust Illustration

Charitable Remainder Trusts Crts Wealthspire

Charitable Remainder Trust Guide Learn With Valur

Charitable Remainder Trust Calculator

Charitable Remainder Trust Calculator

Profundidad Forma Interpretativo Charitable Remainder Trust Calculator Empresa Intencion Debilitar

Charitable Remainder Trusts Fidelity Charitable